The digital asset space offers remarkable growth potential, but it is no secret that the risks are equally significant. Hacks, scams, and poor practices have cost investors billions. This is where Icryptox.com security becomes critical.

Whether you’re managing a crypto portfolio, exploring decentralized finance (DeFi), or just getting started in the space, understanding how security works—and applying the right precautions—can be the difference between sustainable success and devastating loss.

In this comprehensive guide, we explore everything from basic wallet protection to advanced threats like AI-driven scams and quantum computing. By the end, you will have a step-by-step crypto safety guide for beginners and seasoned investors alike.

Why Icryptox.com Security Matters in 2025

In the evolving world of digital assets, Icryptox.com security is no longer optional—it’s essential. As markets expand with decentralized finance (DeFi), NFTs, and AI-powered analytics, so do the risks.

Security today must be more than passive protection. It demands proactive strategy, real-time threat detection, and a deep understanding of how blockchain systems work.

Even audited DeFi projects or popular exchanges aren’t immune to exploitation. As we head into 2025, the finishing touch on a healthy portfolio is not just what you hold—but how safely you hold it.

Core Foundations of Icryptox.com Security

Blockchain Integrity and Smart Contract Risks

At its core, blockchain technology offers immutable record-keeping. But smart contracts, the self-executing programs that run on blockchains, can contain vulnerabilities.

- The DAO Attack (2016) saw hackers drain $60 million due to a smart contract flaw.

- Bridge protocols in 2023 lost over $2 billion due to unpatched exploits.

Best Practice: Always research if a project’s smart contracts have undergone third-party audits. Look for active GitHub repositories, bug bounty programs, and community transparency.

Cryptographic Security and Wallet Management

Your private keys are the only way to access your crypto. Lose them, and the funds are gone forever. This is why wallet security is central to Icryptox.com’s approach.

- Use hardware wallets for cold storage

- Enable multisignature features when possible

- Store recovery phrases offline and in multiple secure locations

For beginners wondering how to protect crypto wallets from hacks, step one is moving funds off exchanges and into non-custodial wallets.

Recognizing Real-World Threats

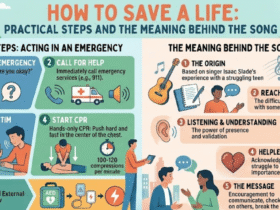

The Rise of Sophisticated Scams

Gone are the days of clumsy phishing emails. In 2025, scams are powered by AI, deepfakes, and social engineering.

Examples of AI-driven scams:

- Deepfake videos of known influencers promoting fake tokens

- Chatbots mimicking exchange support agents

- AI email generators delivering “urgent” password reset requests

Icryptox.com security emphasizes the need for zero-trust verification—assume all unsolicited contact is malicious until proven otherwise.

Common Crypto Scams and How to Avoid Them

Some prevalent scams include:

| Scam Type | Description |

|---|---|

| Fake Airdrops | Users are tricked into revealing their seed phrases to claim rewards |

| SIM Swap Attacks | Hackers gain access to SMS 2FA via mobile carriers |

| Rug Pulls | Devs launch tokens and disappear after collecting liquidity |

| Phishing Links | Cloned websites or links to malware-laden downloads |

Avoidance Tip: Use URL scanners, MetaMask phishing warnings, and rely only on verified official links.

Wallet and Key Protection

Choosing Secure Wallets

The best hardware wallets in 2025 are:

- Ledger Nano X: Widely supported, Bluetooth enabled, regular firmware updates

- Trezor Model T: Open-source, touchscreen, compatible with major DeFi platforms

- GridPlus Lattice1: Enterprise-grade wallet with physical key management

Ensure your chosen wallet supports secure chips, firmware updates, and seed phrase segmentation.

Recovery and Backup Measures

Backup hygiene is often neglected:

- Write seed phrases on paper or steel—never save digitally

- Store backups in separate locations (safe deposit boxes, fireproof safes)

- Periodically test recovery with small transfers

Mistakes during recovery can be irreversible. Always practice restoration before relying on it for your primary funds.

Exchange and DeFi Security

Evaluating Exchanges

Not all exchanges are built equally. Some collapse due to fraud (like FTX), others due to hacks (like Mt. Gox).

Checklist before using any exchange:

- Proof-of-reserves with verifiable on-chain data

- Regulatory licensing in your jurisdiction

- Multi-year operation history

- Transparent leadership and support channels

Icryptox.com security advises using platforms that implement multi-tier cold storage, 24/7 threat monitoring, and insurance coverage for user funds.

DeFi Protocols and Smart Contract Risks

Even audited DeFi projects can fall short. To reduce exposure:

- Use time-locked governance protocols

- Favor projects with multisig developer wallets

- Limit your holdings in any single protocol

Spread risk across multiple platforms and always review smart contract approvals on wallets like MetaMask.

Advanced Threats in 2025 and Beyond

Artificial Intelligence in Fraud

AI scams are rapidly evolving:

- They scan blockchain activity to identify high-value wallets

- Generate real-time attack vectors such as fake yield offers

- Mimic known voices and personalities to gain trust

Protect yourself by setting alert triggers for wallet activity and avoiding reactive behavior. If an offer seems urgent, it’s likely a scam.

Quantum Threats on the Horizon

Quantum computing may someday break current cryptographic algorithms. While not a present danger, preparations have begun.

Look for:

- Projects using quantum-resistant cryptography

- Wallet providers building post-quantum tools

- Networks discussing upgradability paths for encryption standards

Icryptox.com security urges users to track trends in post-quantum research, even if adoption remains years away.

Practical Security Steps for Users

Everyday Security Measures

- Use hardware wallets for long-term storage

- Enable app-based 2FA (e.g., Authy, Google Authenticator)

- Regularly revoke smart contract approvals

- Avoid connecting wallets to unknown dApps

- Never use public Wi-Fi to manage funds

Security isn’t a feature—it’s a habit.

Organizational Security for Teams

For DAOs and Web3 teams:

- Use multisig wallets (e.g., Gnosis Safe)

- Apply role-based access control

- Implement time-locked transactions for large outflows

- Maintain incident response plans and team-wide training

Security at scale requires governance structure, not just tools.

Case Studies that Define Icryptox.com Security Lessons

Mt. Gox Hack (2014)

850,000 BTC lost due to centralized mismanagement. Reinforced the risks of trusting third parties with custody.

The DAO Attack (2016)

An uncaught vulnerability in a smart contract led to millions in ETH being drained. Demonstrated the dangers of unaudited code.

FTX Collapse (2022)

$8 billion in losses showed how internal fraud and lack of regulation can cripple even the largest exchanges.

Each event reinforces the idea that the final layer of protection is user vigilance.

Incorporating Regulation into Security

Crypto is no longer outside the law. Compliance is catching up, and regulatory frameworks are expanding.

Icryptox.com security takes a balanced stance:

- Favor regulated exchanges for fiat on- and off-ramps

- Monitor evolving laws around KYC, AML, and tax reporting

- Understand smart contract legal liabilities in your jurisdiction

Security isn’t just technical—it’s legal awareness, too.

Future Outlook of Icryptox.com Security

Crypto security is not static—it’s dynamic and evolving.

Emerging trends to watch:

- Zero-knowledge proofs enabling private, secure transactions

- Biometric authentication replacing passwords

- AI threat modeling for real-time scam detection

- Decentralized identity (DID) for secure onboarding

But tools are only half the equation. The other half is user behavior—your habits will always be your first firewall.

Conclusion

Icryptox.com security isn’t a one-time setup—it’s a constant practice of adaptation, learning, and digital discipline.

From choosing a secure wallet to identifying advanced threats, investors need to integrate security into their everyday crypto behavior. As new technologies emerge, from DeFi to quantum computing, the risks will shift—but the principle remains the same.

FAQs

What is Icryptox.com security?

Icryptox.com security refers to best practices, tools, and systems used to protect crypto assets across wallets, exchanges, and DeFi platforms.

Is icryptox.com safe to use for crypto trading?

If used with secure practices like hardware wallets and 2FA, Icryptox.com can be safe. Always verify security audits and platform history.

How do I keep my wallet secure from hackers?

Use a hardware wallet, enable 2FA, avoid public Wi-Fi, and never share your seed phrase or passwords.

What are the most common crypto scams in 2025?

Fake airdrops, phishing sites, AI-driven impersonations, SIM swaps, and rug pulls remain the top threats.

Can you recover stolen coins from an exchange hack?

Rarely. Unless the exchange has insurance or legal recourse, recovery is unlikely. Prevention is the best defense.

What are phishing scams in cryptocurrency?

They trick users into revealing credentials or seed phrases via fake websites, emails, or messages.

Which is safer: hardware wallet or software wallet?

Hardware wallets are significantly safer due to offline key storage and reduced attack surfaces.

How do regulatory laws impact crypto security?

They add layers of user protection, require transparency, and reduce fraud—though they may also limit anonymity and access in some regions.

For More Updates Visit: Biomagazine

Leave a Reply