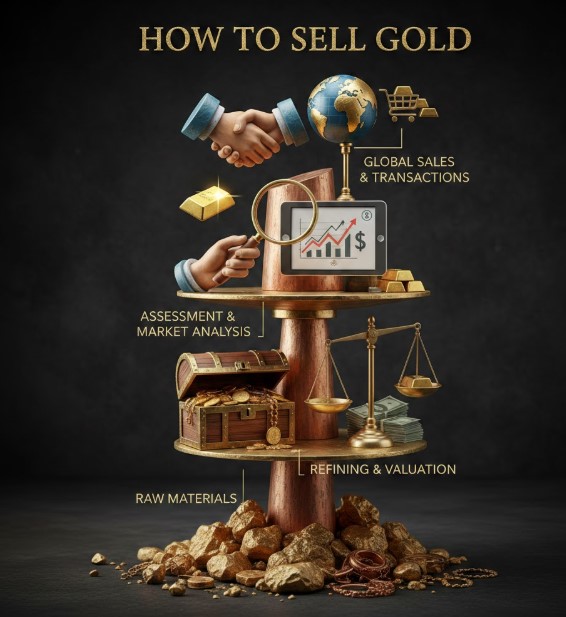

Gold has symbolized wealth, security, and stability for centuries. From ancient trade routes to modern investment portfolios, it remains one of the most trusted assets in the global economy. If you’re wondering how to sell gold for the highest possible return, you’re not alone. Whether you own gold coins, gold jewelry, bullion, or gold bars, understanding pricing, buyer types, tax implications, and safety measures is critical to maximizing profit.

Gold prices fluctuate daily based on international markets such as the London Bullion Market Association (LBMA) and commodity exchanges like COMEX. Knowing how the gold spot price works—and how dealers calculate payouts—can significantly impact your return.

This comprehensive guide explains how to sell gold coins, how to sell gold jewelry, how to sell gold rings, how to sell gold bar, how to sell gold bullion, and even how to approach how to sell gold and silver tax free within legal frameworks. Written with financial clarity and transparency in mind, this article delivers expert-backed insights, actionable strategies, and practical steps to help you sell confidently and securely.

Understanding Gold Value Before You Sell

Before learning how to sell gold effectively, you must understand what determines its value. Gold is priced per troy ounce (31.1 grams), and its price—called the spot price—changes based on global supply, demand, inflation, and economic uncertainty.

When you sell gold, buyers rarely pay full spot price. Instead, they offer a percentage based on purity, condition, weight, and market demand. For example, bullion coins may command higher premiums compared to scrap gold jewelry.

Key Factors That Determine Gold Value

• Gold Purity (Karat or Fineness)

Gold purity directly impacts resale value. Jewelry is often 10K, 14K, 18K, or 22K, while bullion is typically 24K (99.9% pure). The higher the purity, the closer the payout to the market price. Buyers test purity using acid tests, electronic testers, or XRF analyzers to ensure accurate valuation.

• Current Spot Price

The gold spot price reflects real-time global trading rates. Before selling, check reliable sources like LBMA pricing data. Selling during price peaks can significantly increase returns, especially during economic uncertainty or inflationary periods.

• Weight in Troy Ounces or Grams

Gold is valued strictly by weight. Even small discrepancies can affect payout. Weigh items using certified scales and verify buyer measurements to prevent underpayment.

• Market Demand for Specific Items

Certain coins and bars carry collectible or numismatic premiums. Rare coins may sell above melt value. Demand fluctuates based on investor trends and market sentiment.

• Condition and Brand Recognition

Recognized refiners such as PAMP Suisse or Royal Canadian Mint often command higher resale value due to trust and authentication standards.

• Dealer Margin and Fees

Dealers operate for profit and may deduct refining or processing fees. Understanding their margin structure ensures realistic expectations when negotiating.

Also Read:- How to Store Peaches: The Complete Expert Guide to Keeping Peaches Fresh Longer

How to Sell Gold Coins for Maximum Profit

Gold coins are among the easiest forms of gold to liquidate. Popular coins like the American Gold Eagle or Canadian Maple Leaf are highly recognizable and liquid assets.

Selling gold coins involves understanding melt value versus collector value. Some coins carry premiums due to rarity, limited minting, or historical importance.

Strategic Steps for Selling Gold Coins

• Determine if Coins Are Bullion or Numismatic

Bullion coins track gold price closely, while collectible coins may carry higher value due to rarity. A professional appraisal can distinguish between the two and prevent undervaluation.

• Verify Authenticity and Certification

Coins graded by recognized agencies like Professional Coin Grading Service (PCGS) often sell for higher premiums due to verified authenticity and condition.

• Compare Multiple Dealer Offers

Never accept the first quote. Obtain offers from local dealers, online platforms, and auction houses. Differences in payout percentages can be substantial.

• Monitor Market Timing

Sell during strong gold markets when prices trend upward. Market cycles significantly influence investor demand for bullion coins.

• Choose Trusted Buyers

Look for accredited dealers affiliated with reputable organizations like the Better Business Bureau (BBB) for consumer protection.

• Avoid Pawn Shop Undervaluation

Pawn shops often offer lower percentages of spot price. Dedicated precious metal dealers typically provide better returns.

Also Read:- How to Make a Paper Airplane: The Ultimate Step-by-Step Guide for Distance, Speed, and Fun

How to Sell Gold Jewelry Safely and Fairly

When learning how to sell gold jewelry, it’s important to understand that jewelry value is often based on melt price rather than craftsmanship—unless designer branding applies.

Jewelry buyers assess gold content, gemstone presence, and resale demand. Removing stones before weighing may alter payout, so clarify procedures beforehand.

Essential Tips for Selling Gold Jewelry

• Separate Gold from Gemstones

Many buyers only pay for gold weight. Clarify if gemstones are included in valuation or returned separately.

• Understand Scrap Gold Pricing

Jewelry is typically purchased as scrap unless it’s from recognized brands. Expect payout percentages between 60–85% of melt value depending on buyer.

• Get Independent Appraisals

A certified appraisal ensures transparency and prevents underpricing.

• Research Online Gold Buyers

Reputable mail-in services provide competitive quotes, but always verify insurance and return policies.

• Keep Documentation for Tax Records

Maintain transaction receipts for potential capital gains reporting.

• Avoid High-Pressure Sales Environments

Take time to compare offers before committing to a sale.

Also Read:- How to Cut a Mango: The Complete Step-by-Step Guide for Perfect Slices and Cubes

How to Sell Gold Rings for the Best Price

Selling gold rings follows similar principles but may involve sentimental or brand value considerations.

Smart Selling Practices for Gold Rings

• Identify Brand or Designer Value

Rings from luxury brands may fetch resale premiums beyond melt value.

• Check Hallmarks and Stamps

Hallmarks indicate purity and authenticity, influencing buyer confidence.

• Weigh Rings Without Stones

Gold weight should be calculated accurately without gemstone weight inflation.

• Consider Private Sales for Designer Pieces

Online marketplaces may offer better returns for premium rings.

• Time the Sale Strategically

Sell during favorable gold price movements.

• Understand Refining Fees

Ask about deductions before agreeing to a transaction.

Also Read:- How to Meditate Properly: The Complete Beginner-to-Advanced Guide

How to Sell Gold Bar and Gold Bullion

Gold bars and bullion are among the simplest forms of gold to sell due to standardized purity.

Professional Approach to Selling Bullion

• Verify Serial Numbers and Certificates

Authenticity certificates increase buyer trust.

• Sell to Authorized Bullion Dealers

Accredited dealers offer competitive pricing based on live market rates.

• Check Buyback Policies

Some dealers offer guaranteed repurchase programs.

• Avoid Shipping Without Insurance

If selling online, insure packages fully against loss.

• Understand Spread Between Buy and Sell Price

Dealers profit from price spreads; compare multiple quotes.

• Track Real-Time Pricing

Use reputable financial platforms before negotiating.

Also Read:- How to Do a Squat: The Ultimate Step-by-Step Guide for Perfect Form and Powerful Results

How to Sell Gold and Silver Together

Diversified precious metal holdings may include both metals.

Combined Selling Strategies

• Evaluate both metals independently

• Compare dealer spreads

• Understand market demand differences

• Consider tax implications

• Check refining fees

• Monitor gold-silver ratio trends

Also Read:- How to Delete Instagram Account: The Complete 2025 Step-by-Step Guide

How to Sell Gold and Silver Tax Free (Legal Considerations)

Tax laws vary by country. In many jurisdictions, selling gold triggers capital gains tax if profits exceed thresholds.

Legal Tax Strategies

• Consult a certified tax professional

• Understand capital gains exemptions

• Offset gains with losses

• Consider holding periods

• Use tax-advantaged accounts where permitted

• Maintain detailed transaction records

Always verify local regulations before assuming tax-free status.

Also Read:- How to Store Potatoes: The Complete Expert Guide for Freshness, Flavor, and Long-Term Storage

Where to Sell Gold: Comparing Buyer Options

• Local coin shops

• Online bullion dealers

• Auction platforms

• Jewelry stores

• Pawn shops

• Private buyers

Each has advantages and risks. Transparency and research are essential.

Also Read:- How to Read Palms: Complete Beginner’s Guide to Palm Reading, Lines, and Meanings

Conclusion

Knowing how to sell gold strategically ensures you maximize returns while minimizing risks. Whether selling coins, jewelry, bullion, or bars, preparation and market awareness are essential. By understanding purity, spot price, dealer margins, and tax considerations, you can approach the sale confidently.

Gold remains a globally trusted asset, and selling it wisely requires informed decision-making. Compare offers, verify authenticity, monitor pricing trends, and consult professionals when necessary. A thoughtful approach turns a simple transaction into a financially smart move.

FAQs

When is the best time to sell gold?

During strong market prices or economic uncertainty when demand rises.

Do gold buyers pay full spot price?

Rarely. Most offer a percentage based on type and condition.

Is selling gold taxable?

In many countries, profits are subject to capital gains tax.

Can I sell gold without documentation?

Yes, but documentation improves trust and may affect payout.

Should I clean gold before selling?

Avoid harsh cleaning; surface scratches reduce resale value.

For More Updates Visit: Biomagazine

Leave a Reply